Enterprise-GradePredictive Intelligence

Empower your organization with leading KPI forecasts and forward-looking analytics that anticipate market movements before earnings.

$DUOL Daily Active Users Forecast Performance

TickerTrends vs Wall Street Consensus

| Quarter | TickerTrends | Consensus | Actual DAUs | 1D Price Change |

|---|---|---|---|---|

| Q2 2024 | 34.36M | 33.56M | 34.1M | +10.53% |

| Q3 2024 | 37.59M | 37.72M | 37.2M | -0.95% |

| Q4 2024 | 40.54M | 41.09M | 40.5M | -16.95% |

| Q1 2025 | 47.51M | 46.00M | 46.6M | +21.61% |

* Results based on historical performance. Past performance does not guarantee future results.

KPI Predictions That Outperform Wall Street

Predict key metrics with unmatched precision using alternative data signals that consistently outperform traditional analyst consensus.

Our proprietary algorithms synthesize search trends, consumer behavior, and social sentiment to forecast critical KPIs weeks before earnings.

Secure a competitive edge by identifying performance inflections before the rest of the market catches on.

Our Forecasting Methodology

TickerTrends forecasts are powered by a forward-looking model that captures consumer intent signals before the point of purchase. By analyzing real-time search behavior, product discovery patterns, and content engagement across the web, we identify demand trends well ahead of traditional data sources.

Most data providers rely on lagging indicators like credit card transactions or survey-based purchase confirmations. In contrast, TickerTrends detects pre-purchase intent—allowing institutional investors to anticipate KPI surprises weeks before earnings announcements and make high-conviction decisions earlier in the cycle.

Comprehensive Data Coverage

Access real-time intelligence on hundreds of companies with our KPI forecasts and unreported metric trackers that update continuously—not quarterly.

Total companies tracked

KPI forecasts

Unreported metric trackers

Enterprise Intelligence Capabilities

Institutional-grade analytics generating leading indicators, forecasts, and proprietary insights

KPI Forecasting Engine

Generate leading indicators for key performance metrics before earnings releases, consistently outperforming Wall Street consensus with proprietary predictive models.

Unreported Metrics Intelligence

Access estimates and forecasts for critical metrics companies don't disclose publicly—from user engagement to operational efficiency signals that drive long-term value.

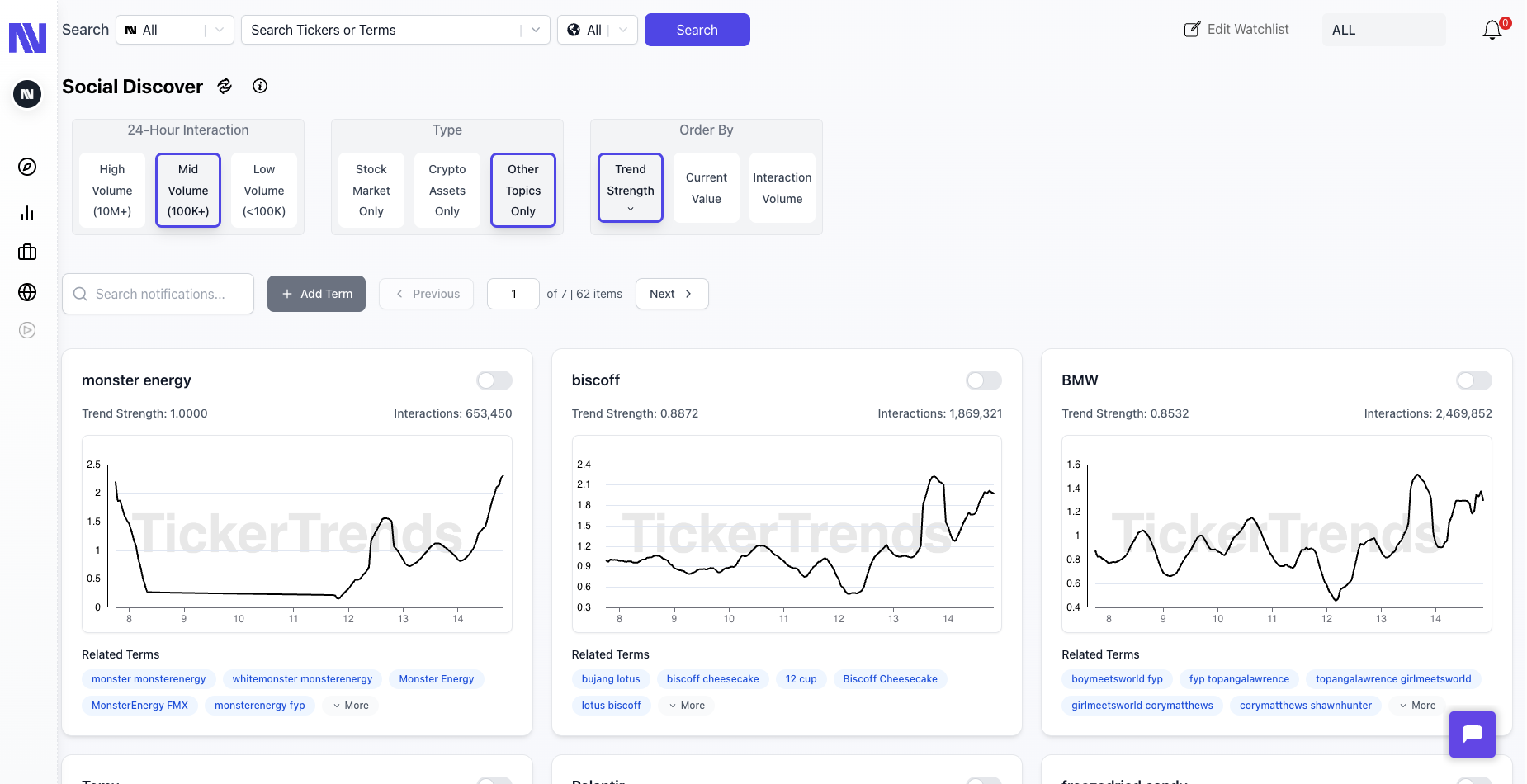

Buy-Side Expectations Analysis

Decode what institutional investors are pricing in with real-time buy-side expectation analysis and sentiment-driven forecasts integrated into your research workflow.

Materiality Assessment

Identify which metrics truly matter for business performance and valuation, with AI-powered analysis that separates signal from noise across your coverage universe.

Real-time Forecast Updates

Receive instant alerts when our models detect material changes in KPI trajectories, enabling rapid portfolio adjustments ahead of the market.

Competitive Benchmarking

Access proprietary competitive intelligence revealing market share shifts and strategic positioning before they appear in financial statements.

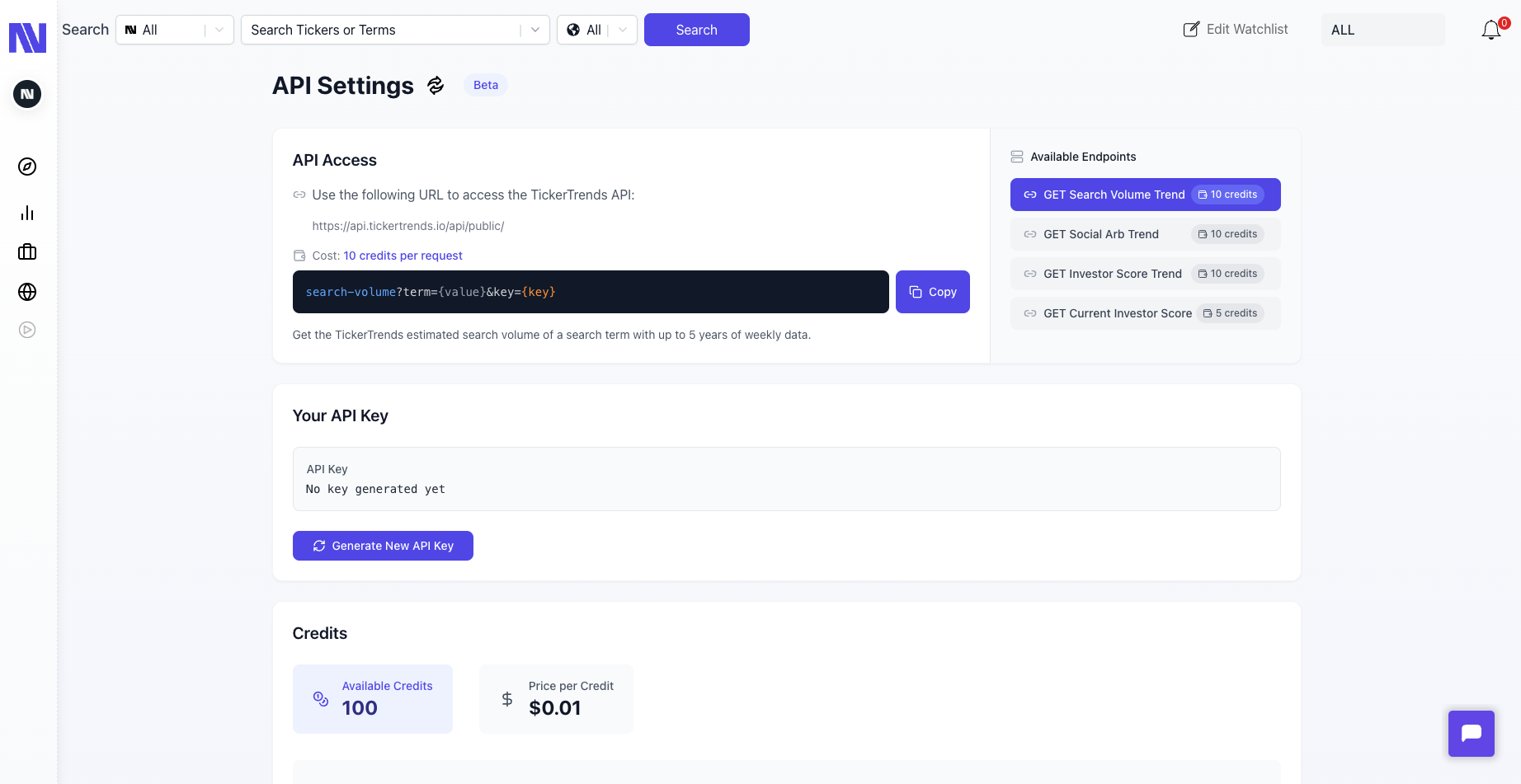

Custom Analytics Models

Tailored predictive models designed for your specific sectors, research questions, and investment thesis validation needs.

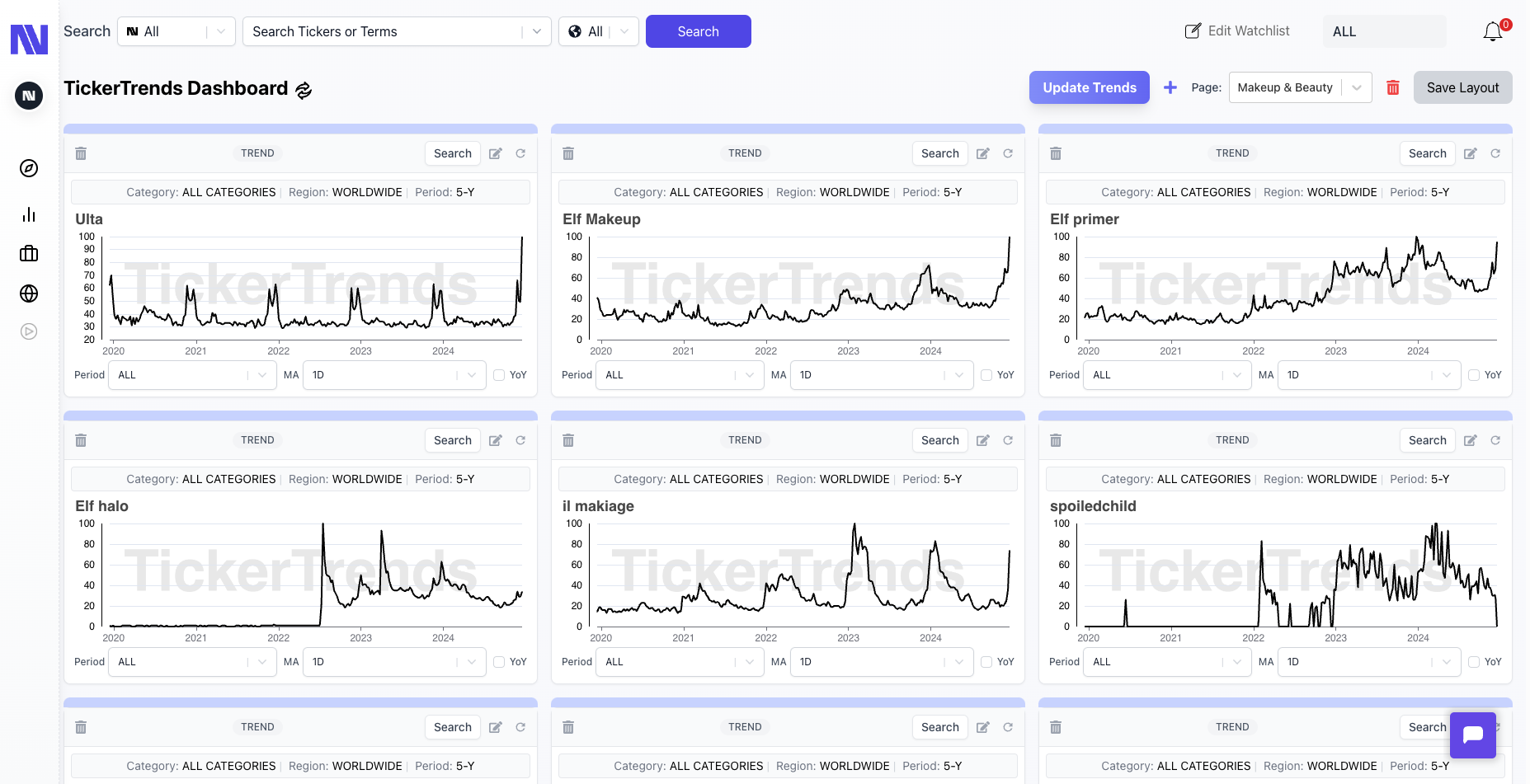

Interactive Forecast Dashboards

Visualize KPI trajectories, confidence intervals, and historical accuracy metrics with institutional-grade analytics dashboards.

Dedicated Research Support

White-glove service with dedicated analysts to help interpret insights, validate forecasts, and customize analytics for your workflow.

Access Predictive Intelligence

Talk to our team about how our KPI forecasts, unreported metric estimates, and buy-side expectations analysis can provide your organization an information edge. Setup a free trial and demo.

@TMTBreakout

Built By Industry Experts

Our team brings together expertise from inside and outside of finance, combining deep market knowledge with innovative technology and data science capabilities.

Deep Industry Experience

Our team combines decades of experience in quantitative finance, technology, and market analysis to deliver institutional-grade solutions.

Data Science

Advanced machine learning models processing alternative data sets to generate actionable market insights.

Technology

Built by engineers with a deep understanding of markets, data, and high-performance computing.

Market Analysis

Expert market analysts with deep experience across all major asset classes and global markets.